Breusch Godfrey Serial Correlation Lm Test Sas

Posted By admin On 09/06/18

I have an OLS model with macro-economic variables like GDP, Unemployment rate as my independent variables. While testing for serial correlation up to order 4 with Breusch–Godfrey test (using proc autoreg in SAS), the test is passing for AR(1) i.e. No serial correlation of order one is present. However the test fails for higher orders. What is the implication of such a test result? Can i go ahead and fit an OLS model instead of error correction models since the residuals don't have an AR(1) structure or will it induce some model risk?

QMS Gareth wrote:Which 'blank' area are you talking about? If you're using the Breusch-Goodfrey Serial Correlation LM Test from the menus, there is no 'blank' area. Open Dental Software Crack. WGTRESID are the residuals, weighted by whatever weight series you used in the original equation. Sorry, I meant the Breusch-Pagan-Godfrey test. Whichever regressors you wish to use in the auxiliary regression for the BPG Test.

The standard, text-book, approach is to use the regressors from the original equation (and EViews usually adds those variables to that white box by default).

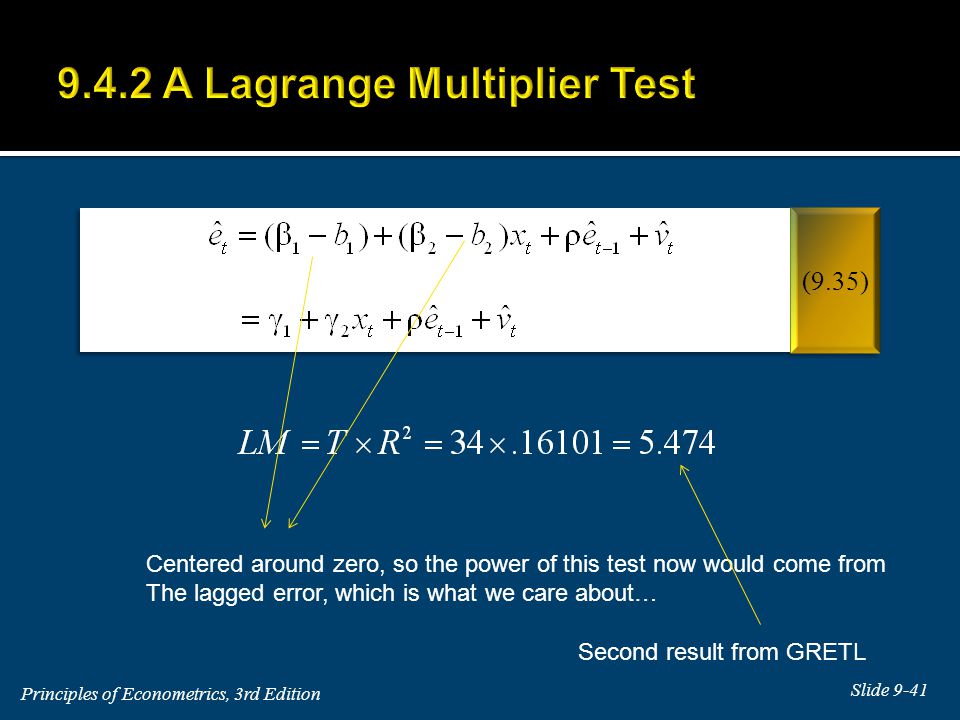

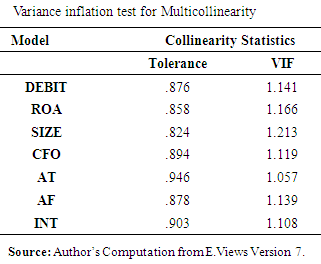

In this clip I explain the main ideas behind testing for autocorrelated regression error terms. This includes. TESTING for SERIAL COORELATION. Breusch-Godfrey Serial Correlation LM test: can be used for AR(1) and higher orders of serial correlation like AR(2), AR(3) etc. Testing for Autocorrelation: The GODFREY= option in the FIT statement produces the Godfrey Lagrange multiplier test for serially. Godfrey's Serial Correlation Test. Log Parser Lizard Gui Crack on this page. The Lagrange multiplier (LM) test proposed by Baltagi and Li (1995) was performed to test autocorrelation in the fixed effects models. The LM test also led to the rejection of contemporaneous correlations at the 5% level. The Breusch-Pagan- Godfrey (B-P-G) test (Greene, 2003) was used to detect heteroscedasticity.