Net Collection Percentage Calculation

Posted By admin On 19/04/18

Terms of use • Complementarily, in order to calculate the Average Collection Period for your business, we offer a calculator free of charge. • You may link to this calculator from your website as long as you give proper credit to C. Consultants Inc. And there exists a visible link to our website. To link to our Average Collection Period Calculator from your website or blog, just copy the following html code: Average Collection Period Calculator and Interpretation • Although C. Consultants Inc.' S personnel has verified and validated the Average Collection Period calculator, C.

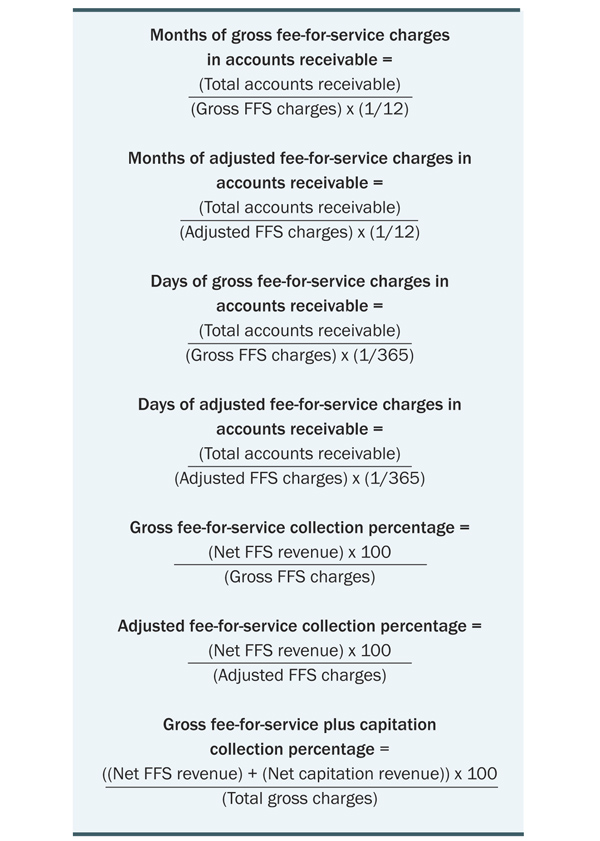

A Textbook Of Geology By P K Mukherjee Pdf To Excel. Understanding Collection Rates Physicians PracticeTo start, I need to calculate the gross and net collection rate of our receivables. Using the most recent A/R. If your net collection rate is lower than 97%, calculate the net collection rate by payer to identify whether a particular payer is the culprit. The adjusted collection rate should be 95%, at minimum; the average collection rate is 95% to 99%. The highest performers achieve a minimum of 99%. Use a 12-month time frame when calculating the adjusted collection rate.

Consultants Inc. Is not responsible for any outcome derived from its use. The use of Average Collection Period calculator is the sole responsibility of the user and the outcome is not meant to be used for legal, tax, or investment advice. What is Average Collection Period Average Collection Period represents the average number of days it takes the company to convert receivables into cash. Average Collection Period formula is: Receivables Turnover Ratio formula is: Average collection period measures the average number of days that accounts receivable are outstanding. This activity ratio should be the same or lower than the company's credit terms. Average Collection Period Analysis As a rule, outstanding receivables should not exceed credit terms by more than 10-15 days.

If you allow various types of credit transactions, then the average collection period MUST be also calculated separately for each category. This ratio takes in consideration ONLY the credit sales. If the cash sales are included, the ratio will be affected and may lose its significance. It is best to use average accounts receivable to avoid seasonality effects. If the company uses discounts, those discounts must be taken into consideration when calculate net accounts receivable. Average Collection Period is figured as days. A popular variant of this ratio is to convert it into receivables turnover ratio in terms of 'turnover times'.